Featured

-

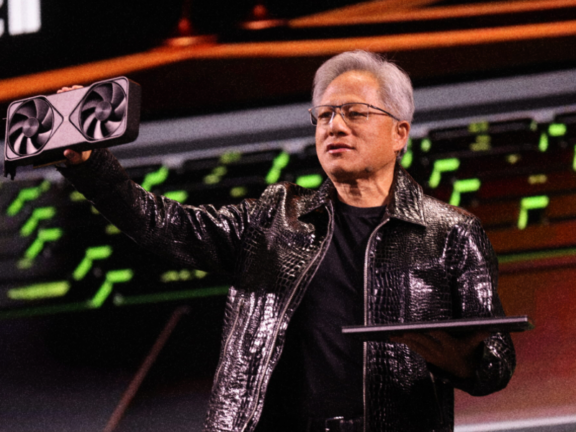

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Hung Debt for Days

Traders are levering up on rate cut bets like never before, a federal court struck down the ‘noncompetes’ ban, CrowdStike is salty about rivals picking up their scraps, and Musk’s Twitter LBO is now the worst deal for banks since 2008.

-

Slow Death of DEI

Firms re-listing in US are seeing valuation boosts, investors are piling back into stocks, more Americans are concerned of job security, and Harley-Davidson dropped DEI efforts.

-

Tough Times For Startups

NFL will meet to discuss PE ownership, SEC was accused of censoring research, RBC countersued their ex-CFO, global stocks capped off a mega week, and US start-up failures are surging.

-

One Man’s Trash, Another Man’s Billable

Bank of America will sponsor the 2026 FIFA WC, money-market assets rose to a new record, Dalio Family Office’s CIO unexpectedly resigned, EY and KPMG are picking up PwC’s China scraps, and Starbucks’ new CEO is living the dream.

-

Volatility Fears Fizzle

The VIX is falling at record pace, BofA urged bankers to report overwork after a scathing report, Millennial wealth is surging, and hedge funds continue to lean into AI amid portfolio reshuffles.

-

Elliott Taking No Ls

Investors are plowing into the Big Tech dip, US is considering breaking up Google, Eurozone investor confidence collapsed, Elliott is going after Southwest’s board, and Starbucks fired and replaced its CEO, causing a $20B share rally.

-

BofA is overworking its bankers

Markets remained relatively calm on an information-light trading day. Meanwhile, BofA is dangerously overworking junior bankers, Elon Musk interviewed Trump on X, private credit is gambling on consumers, and the Olympics memes keep rolling in.

-

Grande Lattes Deserve Grande Returns

Activist investors are pouncing on Starbucks, Hindenburg is back with more Adani drama, retail investors were unfazed by the dip, UK inflation is forcing couples to stay married, and investors are taking major directional bets amid a volatile market.

-

Intel’s Billion Dollar Blunder

Lazard is on a hiring spree, Trump wants presidents to influence rate policy, Google and Meta struck a secret ads deal, Jeff Bezos is investing exclusively in AI, and Intel reportedly passed on one of the best investments of the decade.

-

Short volatility in this economy?

Short vol bets got clapped, corporate credit spreads surged, JPMorgan raised US recession odds, Lumen became an AI stock overnight, and UK wants to emulate the Maple 8.

-

PE Under Fire Per Usual

Lawsuits are piling on KKR’s founders, Vista is winding down its hedge fund, SEC is investigating banks over alleged cheating, traders piled into Treasury longs at record pace, OpenAI’s co-founder joined rival Anthropic, and Kamala chooses Minnesota Gov. Tim Walz as VP pick.

-

Kuro Monday

Global stock markets got cooked, traders piled into tail-risk hedges, retail brokerages were hit by outages, Google search was found to be an illegal monopoly, and Japan markets re-lived Black Monday only to rally the next day.