Featured

-

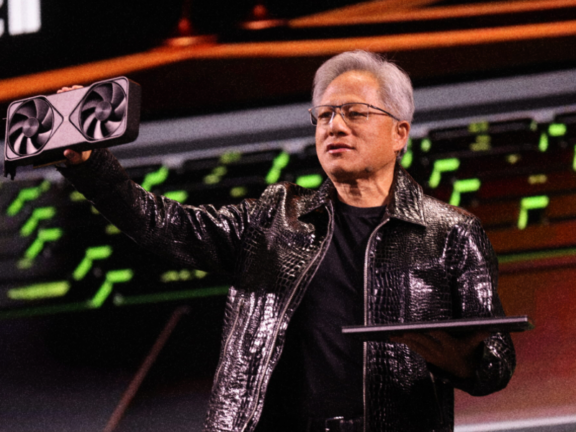

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

‘Twas Fun While It Lasted

Nasdaq entered correction territory, Japan stocks entered a bear market, the yield curve almost un-inverted, economic data triggered a recession rule, and a junior IB analyst won gold at the Olympics 💪🇺🇸

-

YOLO Nvidia Bets Are In

Nvidia volatility surpassed Bitcoin’s, a divided BoE cut rates, hedge fund allocation to China hit a five-year low, Google is hoarding Nvidia chips for YC-backed startups, and the 9/11 mastermind will avoid the death penalty.

-

Credit Where Credit is Due 🤷

Stock market ripped, Japan raised rates, shareholders sued CrowdStrike, Bill Ackman canceled IPO plans, KKR is swimming in fees, Oaktree exited to Kylian Mbappé, and Ares smashed HPS’ record with a behemoth private credit fund.

-

Mid Tech Earnings

‘Earnings Super Bowl’ week continues on as as early Big Tech earnings came in mixed. Elsewhere, Spirit is abandoning its low-fare strategy, wealthy investors are driving record gold demand, and Intel is laying off thousands.

-

Wells Fargo’s DEI Sham

Wells Fargo conducted sham interviews for DEI candidates, UK is cracking down on PE bonuses, Hedge funds are ditching European shorts at record pace, and Toyota’s chairman may lose his board seat.

-

SPACs Are Back

Short seller Andrew Left was criminally charged, SPAC deals are poised for a comeback, Hudson Bay accused the Fed of engineering lower long-end yields, and Bill Ackman delayed the IPO of his new closed-end fund.

-

Nepotism Drama on the Street

OpenAI unveiled a search engine to rival Google, WhatsApp hit 100M active US users, Bill Ackman’s newest fund may raise ~90% less than he planned, and David Rubenstein’s daughter resigned a top job after cronyism claims

-

Yet Another Clappening

China is ensuring AI models are socialist, Colin Kaepernick launched an AI startup, Chinese quant funds are struggling, CrowdStrike may cost Fortune 500 firms over $5B, and US stocks continued to get wrecked.

-

Big Tech Earnings Flash Warnings

LPs are wary of PE continuation funds, FTC is probing ‘dynamic pricing’ practices, US home prices hit a record-high, insurers are set to lose billions from CrowdStrike’s glitch, and early Big Tech earnings came in mixed.

-

M&A Fee-lemmas

‘Twas a pretty calm day in markets, with stocks regaining ground after last weeks selloff and businesses continuing to reel from CrowdStrike’s glitch. Meanwhile, a slew of failed M&A deals are making bankers rethink fee structures.

-

Buh-Bye Biden

A CrowdStrike glitch nearly crippled the global economy, Taleb’s protege thinks the greatest bubble is at its peak, secondaries had a record H1, and Biden dropped out of the presidential race.

-

Blackstone’s Back in Business

Blackstone increased its pace of investments, foreign holdings of US debt hit a record high, OpenAI is exploring making its own AI chips, and Amanda Staveley is going football club shopping.