Featured

-

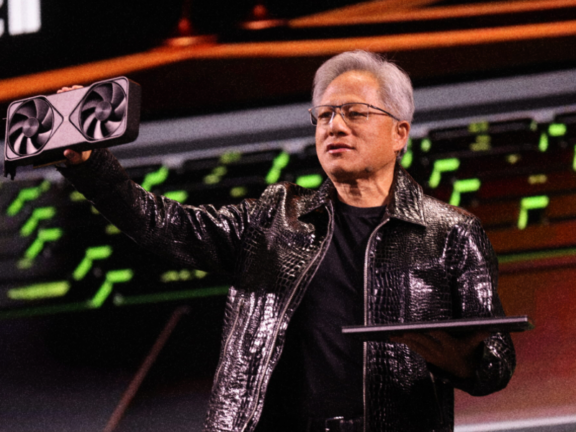

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Fat Fingers at Archegos

The bond king expects a 2024 recession, banks are ramping up RTO demands, Segantii will return capital to investors, US sued to break up Live Nation, and Archegos accidentally wired $470M to Goldman during their collapse.

-

Oaktree Milan

Oaktree seized control of Inter Milan, PE is eyeing college sports, Fidelity halted European private credit activity, PwC is facing heat in China, DuPont will split into three, and Nvidia pulled off yet another Nvidia.

-

Rite Aid Bankers Punching the Air

NY is cracking down on certain vulture funds, Blackstone will grant equity to employees of firms it LBOs, asset managers are turning to finfluencers to boost ETFs, and Rite Aid creditors asked the firm’s bankers to reduce advisory fees.

-

Not Just Another Investor Day

Jamie Dimon hinted at early retirement, Janet Yellen is against a global billionaire tax, JPMorgan’s Kolanovic is the last prominent Wall St bear, and Scarlett Johansson rebuked OpenAI for ripping off her voice…which naturally called for some hilarious memes.

-

🚨Dow 40k🚨

European PE is struggling to exit, London is the leading European city for finance investments, investors are eyeing cheap UK stocks, OpenAI disbanded its risk team, and the Dow closed above 40k for the first time ever.

-

Sign of the Times

Investors are reaching for riskier assets, JPMorgan will expand back office recruiting to non-targets, Ray Dalio warned of US bond market threats, rate cut views remained steady on CPI data, and Microsoft asked China AI employees to relocate amid tensions.

-

Gas vs Green: The Battle of the Shorts

An unlikely billionaire is bidding for TikTok, credit assets are outperforming at PE mega funds, Chevron overtook Tesla as the most shorted big-cap, and HSBC and Deloitte are withdrawing UK job offers over new visa rules.

-

More Drama on Jane Street

Jane Street traders who shared secrets were salty about pay, investors are most bullish since late-2021, Vanguard named a new CEO, big-name funds are piling into real estate debt, China is considering buying unsold homes, and meme stocks continued their meme worthy rally.

-

Roaring Kitty…Roaring Stocks

Retail investors are pulling out of European hedge funds, corporate greed may not be driving inflation, NYSE’s President is bullish on IPOs, and meme stocks soared again as if they never left.

-

Sunset Over the Renaissance

Covid-era job switchers are less satisfied now, the closing of Trump Media’s auditor may cause IPO delays, US wants to ban certain event derivatives, Fed’s Logan thinks monetary policy is not tight enough, and quant fund legend Jim Simons passed way…RIP to the best to ever do it.

-

The Beginning or the End?

BP wants a piece of Tesla superchargers, OpenAI is set to announce a Google search competitor, Bridgewater’s new CEO has ‘rewired’ the hedge fund, Goldman is making the most of Japan’s market rally, and lenders are seeing a bottom for consumers.

-

Indian Alternatives Looking Mainstream

Investors are loving Indian healthcare PE and junk bonds, Texas electricity markets are out of control, Sweden became the second rich nation to cut rates, BNPL is generating billions in unaccounted-for debt, and over 85% of the best Covid-era stocks are down since Covid.