Featured

-

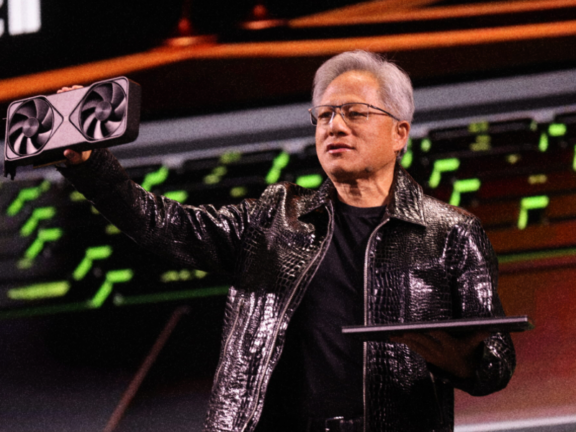

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Cathie Wood’s Bitcoin to Outer Space

Japan PE nearly tripled last year, China is investigating PwC for its role in Evergrande’s fraud, Goldman’s hedge fund clients are getting active in crypto, big tech founders are cashing out on stocks, Canada will cap mortgages for certain borrowers, and Cathie Wood valued Bitcoin at $1.5M.

-

No Indication of a Recession

Williams F1 seemingly ran its entire F1 operation on one excel sheet, global IPO headlines were booming yesterday, Switzerland surprised with a rate cut, Germany betrayed Adidas for Nike, Amazon is fearsome of Temu and Shein competition, and US yield curve inversion is now the longest on record.

-

Julian Assange Might Beat the Case

Union workers are seeing massive wealth gains, US is no longer a top 20 happiest country, high rates are not slowing borrowing, European borrowers are barely defaulting, the Fed will slow the rate of QT, and Julian Assange might soon be a free man.

-

Beginning of a Bitcoin Monopoly

JPMorgan set up a sports IB team, Wall Street and Europe IB bonuses declined, Texas schools pulled $8.5B from BlackRock, bond traders are upping short bets, CalPERS will invest over $30B in private markets, and MicroStrategy now owns ~1% of all Bitcoin.

-

Can Barings Bear the Heat

40 high-profile traders from Citadel and others are expected to debut their own funds this year, BOJ entered a new regime of monetary policy today, PE is seeking help from private credit, the corporate bond rush is defying high rate fears, and the Corinthia-Barings drama might just make for a thriller movie.

-

No Stopping the Charging Bulls

Traders can’t care less about a selloff, PE funds are struggling to exit China investments, middle managers are facing the worst of layoffs, Nvidia is not the best performing tech stock, SBF considered coming out as Republican, and home buying costs could fall big after a groundbreaking settlement.

-

Everything-Backed Securities

Goldman has a women exodus problem, PE is betting on everything that’s ever financed, corporate defaults are matching 2008 levels, Morgan Stanley named an AI head, a hedge fund manager is facing arrest, and TikTok M&A is heating up.

-

Busted Banks to Booming SPACs

Goldman is the sole bull on US commercial real estate, hedge fund leverage is near record highs, PwC Australia let go of 37 partners, a new SPAC plans to merge with failed US banks, and FT published a hit piece on how Evercore is closing in on bulge bracket rivals.

-

The Goldman Age of Private Credit

Police raided AC Milan over their Elliott PE sale, Toyota shorts are out in full force, Goldman is seeking a $300B private credit portfolio, FC Barcelona may break up with Nike, an ex-Wall Street banker is challenging AOC for Congress, and cocoa markets are on the brink of chaos.

-

PE is Not Cooking

A Boeing whistleblower was found dead, Jamie Dimon warns a US recession is “not off the table” yet, PE is sitting on record unsold assets, big tech isn’t the sole stock rally driver, Europe’s IPO market is recovering quick, Biden unveiled a $7.3T budget, and ISIS is increasingly relying on crypto to fund operations.

-

Audi F1: A New Era

Investors dumped tech stocks at the fastest rate ever, investors are flocking to all sorts of bonds, EY deals staff are sick of their leaders, BOJ may exit negative rates, hedge funds are threatening to pull out of India investments, and Sam Altman returned to OpenAI’s board.

-

Don’t Bank on the Banks

US has a growing bank problem, bank profits dropped by half due to bank failure costs, leveraged Nvidia bets are at record highs, SMBs are optimistic despite debt burdens, Canadian bank execs missed bonus targets, and Ray Dalio wants Taylor Swift for President.