Featured

-

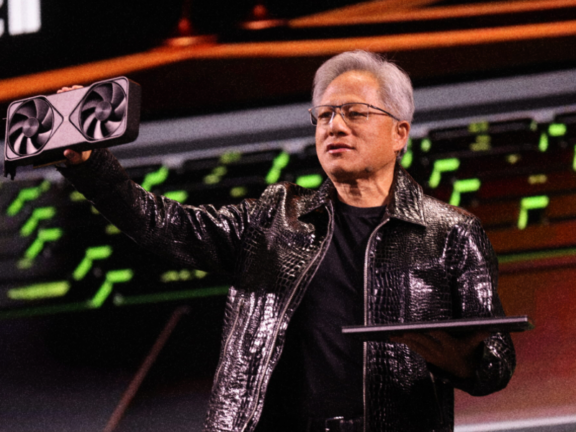

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Gloomy Spirits

Together with Good Morning, Fed independence is a top election concern for Bridgewater, emerging market investors are shunning China, BoC increased the pace of rate cuts, Warren Buffett declined to endorse any candidate, Tesla rebounded from its H1 slump, and Spirit is looking to sell itself in bankruptcy. Sick of being burnt by outdated CPAs …

-

Dimon & Gates back Harris

Together with Good Morning, We’re less than two weeks away from the US presidential election and everything is firing on all cylinders. PE fees are at the lowest on record, regulators are sounding the alarm on private credit, EY fired staff for some bizarre reasons, OpenAI hired its first economist and compliance chief, and Bill …

-

Roaring Twenties v2.0

Together with Good Morning, Chinese share buybacks hit a record high, Trump's lead on betting markets surged, Larry Fink thinks the election won't impact markets, and the S&P rally is breaking records going back to the Great Depression. Gain exposure to recession-friendly real estate with today's sponsor, FNRP. Let's dive in. Before The Bell As …

-

Rev Up Those Fryers

Together with Good Morning, Markets are betting on a Trump victory, PwC is offering 'MD' titles to retain senior staff, CVS fired and replaced their CEO, Prada is designing spacesuits for NASA's moon mission, and Trump picked up a shift at McDonald's. Eilla AI just launched the first end-to-end AI platform for everything M&A, PE …

-

Meal Controversies at Meta

Together with Good Morning, Harvard donations are down sharply, Israel killed Hamas' leader, PIMCO says private credit is overvalued, McKinsey is overhauling is China operators, and Meta fired staff for abusing their meal stipend. Supercharge your investment research and streamline all your analysis and diligence work with Rogo, the leading GenAI platform for finance. Let's …

-

Bonus Bounceback?

Together with Good Morning, Traders are eying fat bonuses on a Wall Street rebound, PE secondary sales are surging to new records, analysts set a low bar for Europe Q3 earnings, and SpaceX sued California for politically-motivated regulations. On the brighter side of California, the Litquidity team just touched down in LA and we’re hosting …

-

Big Banks Are Back to Banking

Together with Good Morning, Election betting markets are surging, Guggenheim got caught in the Starboard-Pfizer battle, investor optimism jumped by the most since Covid, and big banks reported a major rebound in Q3 dealmaking activity. Plaid just released their webinar dissecting what the upcoming open banking regulation means for you and your company. Check it …

-

Earnings In for a Surprise

Together with Good Morning, Elliott launched its first proxy fight in seven years, Keir Starmer vowed to rip up UK's regulatory bureaucracy, Chinese EVs are crushing European competition, and Q3 earnings may blow past estimates on unusually bearish analyst sentiment. Accelerate and streamline your M&A workflows like never before with today's sponsor, SS&C Intralinks DealCentre …

-

The Soft Landing Is Here

Together with Good Morning, Chinese equity inflows shattered records, EY delayed start dates for graduates, Trump is gaining in on Harris, JPMorgan declared a 'soft landing' for the US economy, and Elon Musk had a weekend. Automate your complicated business spend and expense allocation process with one of the fastest growing fintech softwares in the …

-

OnlyCash

Together with Good Morning, PE firms' assets are struggling under heavy debt loads, China investors are expecting a wave of new stimulus, the Pfizer-Starboard clash is heating up, and OnlyFans creators are rolling in the dough. Up your financial modeling, pitch book curation, and everything Excel with Macabacus, the ultimate Office productivity add-in for finance. …

-

Europe’s Economy Can’t Cope

Together with Good Morning, Germany is forecasting its first two-year recession in two decades, BofA is losing work over its Asia block-trading probe, Jamie Dimon questioned pensions' private market investments, and China's stimulus rally took a major breather. Check out BILL's smart corporate credit card and they’ll send you a pair of new Apple AirPods …

-

Bad Day To Be a Block

Together with Good Morning, Yesterday was another calm day on the headline front, with the China craze and Mideast stealing much of markets' attention. In other interesting news; US is weighing breaking up Google, Pfizer's CEO will meet its activist investor, and Hindenburg shorted Roblox. Master all your valuation methods and stand out as a …