Featured

-

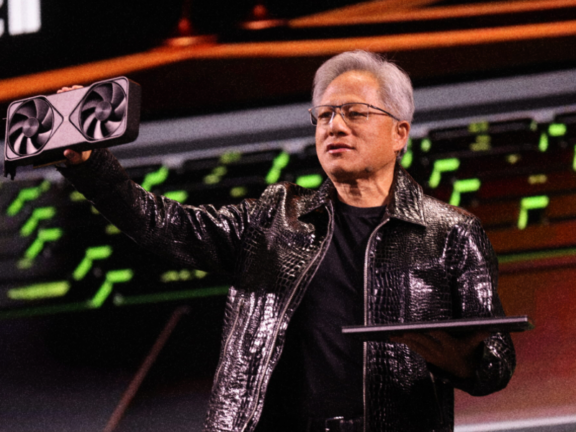

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Nvidia 500

AI continues to carry the entire stock market, Bain is pulling back from work in China, US banks hiked Q3 dividends, Amazon is pivoting into an AI company, and the presidential debate became the meme of the weekend.

-

AI-Driven Crypto M&A

UK PE leveraged loan defaults are soaring, US IPOs are having their best start since 2021, Asia M&A fees hit a decade low, SCOTUS stripped SEC of major enforcement powers, and crypto caught M&A fever.

-

“My daddy works at Morgan Stanley😎”

Q1 private credit returns were nearly double of PE, all major US banks passed the Fed’s stress test, the US convertibles market is booming, consultants are reaping big from AI-related work, and an ex-Segantii trader’s pay lawsuit took an embarrassing turn.

-

a16z PE

a16z is moving into PE, PJT’s founder expects dealmakers to move from big banks to boutiques, machines are taking the helm at AQR, Amazon is working on a ChatGPT rival, and on-cycle PE recruiting kicked off in the most meme-worthy fashion…

-

Mega-Fund-Raising Frenzy

HPS raised the largest-ever private credit fund, KKR is eyeing its biggest buyout fund yet, Bobby Jain’s hedge fund is debuting with over $5B, Premier League clubs are projecting record revenues, and Julian Assange is set to walk free.

-

Much Needed European Charity

US credit spreads widened amid political uncertainty, Asian L/S strategies are beating out global peers, emerging market currencies are struggling, Carlyle is betting on a slow energy transition, and American tourists are driving Europe’s economic engine.

-

How to Train Your Traders

Hedge fund talent schools are seeking the perfect trader, Apollo sees no Fed rate cuts this year, Citi is bullish on Europe, Anthropic debuted its ‘industry-beating’ AI model, and Revolut is selling shares at a $40B valuation.

-

Whole new meaning to ‘Netflix & chill’

Golden Goose abandoned its IPO at the last-minute, Point72 is readying a new AI L/S fund, Bayview re-ignited a 2008-era CDS trade, UK reclaimed Europe’s stock market crown, an OpenAI co-founder debuted his own startup, and Netflix launched an ambitious retail experience.

-

Event-Driven Driving Gains

M&A-focused strategies are leading the hedge fund pack, Goldman and Evercore are bullish on stocks, Deutsche Bank is going all in on IB, Apple will shut down BNPL, and one crypto came full circle to adopt the gold standard.

-

French Markets Surrendered

Bonjour folks…European markets got rekked last week as political uncertainty rattled traders. But as the French famously say “Après la pluie, le beau temps” so we’ll stay hopeful that things turn around. Reminder, markets are closed Wednesday for Juneteenth so hope y’all enjoy a short week ahead🙏

-

JPMorgan Biotech & Co.

JPMorgan is betting on weight-loss drugs, PE firms have made over $1T in performance fees, Wells Fargo fired employees for faking work, producer prices unexpectedly declined, and European bond markets are on the verge of fracture.

-

Goldman vs Google: The ‘Board’ Wars

Goldman and Google and vying for chess supremacy, America is experiencing a ‘Zyndemic,’ PE firm Permira named new co-CEOs, the world could soon see a massive oil glut, and Trump wants all remaining Bitcoin to be made in USA.