Featured

-

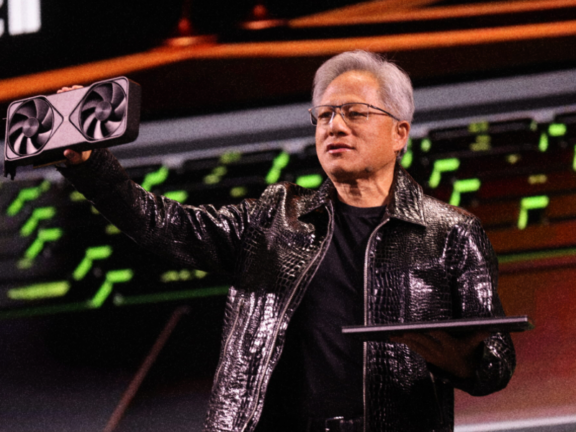

Nvidia (probably) saved the day

Together with Good Morning, Nvidia’s crucial earnings beat didn’t do much to boost stock market sentiment after-hours, at a time where US equities are already taking a beating. On a related note, active fund allocation to Big Tech stocks fell to the lowest since 2008. Move on from the daily deluge of tedious tasks and …

-

Mediocre 7

Together with Good Morning, US stocks tumbled further after another round of pessimistic economic data, with major indexes turning negative YTD and Big Tech stocks taking a blow on the compounding threat of Chinese AI competition. Investors are nevertheless unironically hoping for Nvidia’s earnings today to change the tide. Automate your complicated business spend and …

-

When AI meets Wall Street. A deep dive on Brightwave

Brightwave is revolutionizing the way Wall Street professionals work with their powerful AI platform. If you work in financial services, this deep dive is for you.

More from the archive

-

Roaring US betting markets

Oaktree criticized Advent and Silver Lake in a rare public call-out, the US yield curve un-inverted, Palantir and Dell are joining the S&P 500, OnlyFans is swimming in cash, US sports betting industry is firing on all cylinders, legal political betting markets are here, and Kendrick Lamar is headlining Super Bowl 2025 (*Drake punching the air rn*).

-

Insider Insights from BofA

BofA was accused of sharing insider information with investors, money-market fund assets hit a record-high, a16z is leaving Miami, and family offices AUM is set to to surpass hedge funds by 2030.

-

Public Private Credit

Apollo is planning a trading desk for private credit, hedge funds remained steady amid August’s turmoil, foreign investors are fleeing Asian tech stocks, and Goldman is projecting an economic boost from a Harris presidency.

-

Stocks in Manager Mode

US subpoenaed Nvidia, Norway may divest from Israel war stocks, bond traders are pricing in a historically steep Fed easing, and capital markets got ACTIVE despite another stock market clappening to kick off September.

-

Boiling Point at the AI Foundry

The S&P is beating all major AI-themed ETFs, private credit is eyeing student loans, Intel is planning a major restructuring, UK tax reform could spark a PE exodus, and Nvidia employees are being overworked like bankers.

-

Leveraged Little Leagues

PE is looking to LBO little league sports, Apple and Nvidia are set to invest in OpenAI, Intel is in its flop era, X might be banned in Brazil soon, and the Dow closed at a new all-time high.

-

Nvidia is *literally* the economy

Nokia released a ‘dumb’ phone for Gen Z, Two Sigma’s co-founders stepped down, Berkshire Hathaway hit a $1T market cap, OpenAI is seeking a $100B+ valuation, and Nvidia once again kept the US stock market afloat…literally

-

Coming Soon: Blackstone Giants vs Vista Cowboys

NFL voted to allow PE investments, Hindenburg shorted Super Micro, Intel’s struggles are causing cracks in their board, US companies are tweaking DEI policies, and China is planning a major bond market intervention.

-

Big Tech Battles For Free Speech

Biden admin ‘repeatedly pressured’ Meta to censor content, France released a statement on Telegram co-founder’s arrest, Dow closed at a record high, and Eurizon’s CEO sees currency as the only market risk that’s not priced in.

-

European tech oversight is getting out of hand

PE firms are hitting the brakes on China deals, Telegram’s co-founder was arrested in France, CU Boulder football sought NIL funding from the Saudis, and Crayola trademarked the smell of its crayons.

-

Chick-fil-A and Chill

Diddy was an investor in Musk’s Twitter LBO, Chick-fil-A is launching a streaming service, US law firms are offering fat bonuses for talent referrals, and a bank CEO got 24 years after falling for a crypto scam that collapsed his bank.

-

Hard landing ‘in hindsight’

US job growth was revised massively downwards, China is battling record-low yields, BlackRock support for ESG measures hit a new low, Western Asset’s CIO is under investigation, and Walmart sold its entire JD.com stake.